Verification Cases by FTA Agreement

Post verification Case 1

RCEPOverview

- FTA Agreement

- AKFTA

- Import duty

- 6.5% (MFN) / 5% (FTA)

- Counterparty Country

- Korea

- HS CODE

- 3901.30

- Item Description

- EVA Co-polymer

- PSR

- CTH

- Issues

- Authenticity of Certificate of Origin and Determination of Origin Criteria

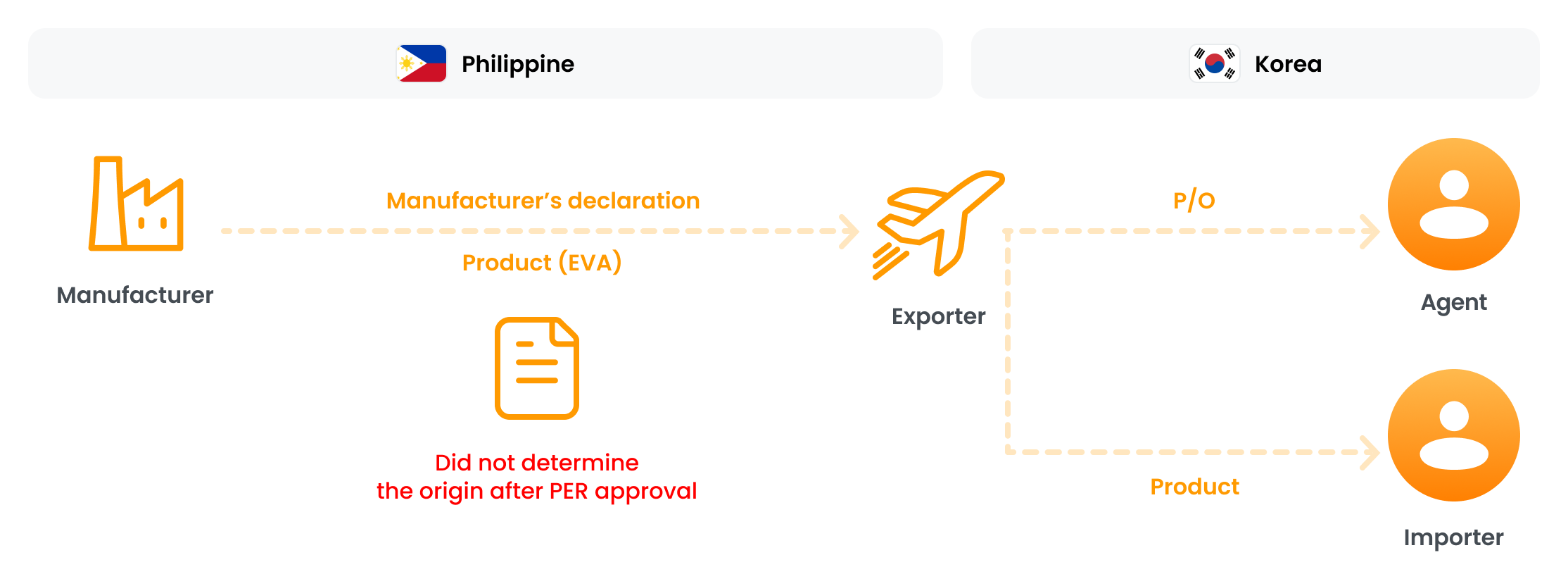

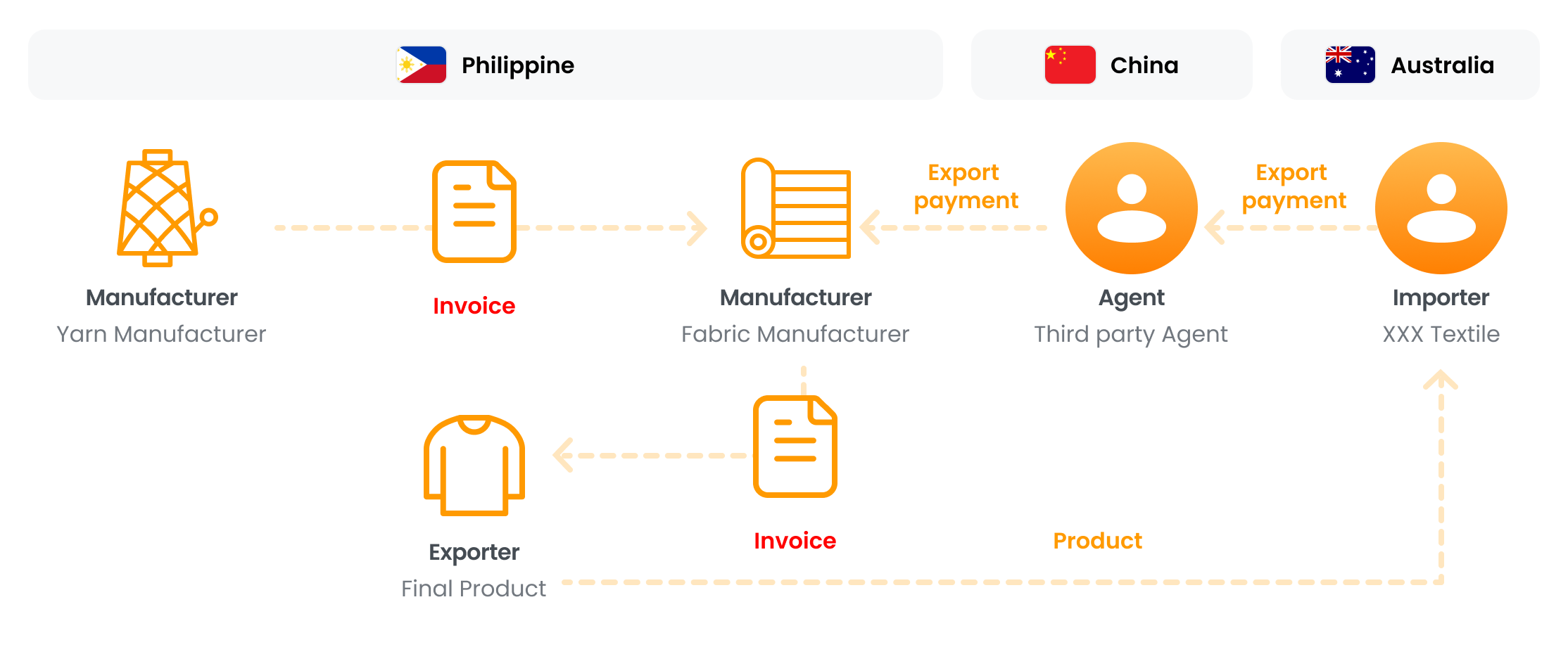

Transaction

Issues on Workflow

Post verification Case 2

PH-EFTAPost verification preparedness methods

- FTA Origin Education for Relevant Departments of manufacturer

- Manufacturers are required to provide justification for the basis of origin determination. Therefore, it is essential to quickly conduct FTA origin education for relevant departments such as the purchasing team and the overseas sales team to ensure cooperation in verification responses.

- Accurate Origin Determination

-

Since the product is purchased and then exported, it is necessary to review

the appropriateness of origin determination based on the manufacturer's

origin documentation. However, the manufacturer’s BOM (Bill of Materials) is

confidential and cannot be disclosed to the exporter.

After determining the origin internally, only the results of the determination should be provided to the exporter or submitted directly to customs, requiring the preparation of origin determination documents.

- Storage of Origin Determination Documentation

- According to the agreement, data keeping is mandatory. Therefore, all origin determination documents and origin declaration forms received from the manufacturer must be retained.

Implications

Promote cooperation in verification responses at the company-wide level by providing FTA training to relevant departments of the manufacturer.

It is necessary to make internal efforts to check whether the origin continues to meet requirements even after PER approval.

Post verification Case 3

AANZFTAOverview

- FTA Agreement

- AANZFTA FTA

- Import duty

- 5% (MFN) / 0%(FTA)

- Counterparty Country

- Australia

- HS CODE

- 5515.11

- Item Description

- Staple fiber fabric

- PSR

- OTHER(SP)

- Issues

- Verification of compliance with origin determination criteria for textiles

Transaction

Issues on workflow

Post verification preparedness methods

- Conduct accurate product classification through advance ruling on tariff classification

-

Product classification is an important criterion for determining origin, so

it is necessary to classify the correct HS code through advance rulings or

other methods.

During post-verification, the counterpart country may inquire about the HS code classification basis for the goods.

- Verify actual processing at each stage of processing criteria

-

For export items subject to processing criteria, it is necessary to verify

the actual processing at each stage in advance.

If possible, it is advisable to obtain supporting documentation that confirms the processing at each stage.

Implications

For export items subject to processing criteria, it is necessary to verify the actual processing at each stage in advance.

If possible, it is advisable to obtain supporting documentation that confirms the processing at each stage.

Post verification Case 4

ATIGAOverview

- FTA Agreement

- ATIGA

- Import duty

- 30% (MFN) / 0%(FTA)

- Counterparty Country

- Thailand

- HS CODE

- 8479.89

- Item Description

- Large scale equipment

- PSR

- RVC 40

- Issues

- Verification of compliance with origin determination criteria

Transaction

Issues on Workflow

Post verification preparedness methods

- Utilize exporter support from relevant agencies

-

Post-verification requires prompt response, and failure to adequately

address verification issues can lead to a loss of trust from import country

buyers.

Therefore, swift action through government export support programs of DTI, BoC is essential.

- Need for Tariff Classification of Raw materials

-

Accurate tariff classification of raw materials is crucial for compliance

with origin determination criteria and for ensuring correct customs duties

and regulatory requirements.

Proper classification helps in verifying that products meet trade agreement requirements and prevents potential issues during post verifications especially for large scale equipment which has a lot of raw materials.

- Need for BOM management after PER Approval:

- After PER approval, the BOM may change, and there could be modifications in input materials or changes in their purchase prices. Therefore, it is essential to manage change records effectively to respond promptly to post-verification processes.

Implications

Post-verification requires prompt response, and contacting the relevant export support department of related agencies for assistance with response strategies is crucial.

For companies dealing with large-scale equipment, it is especially important to issues related to product classification and to continuously update the BOM to ensure adequate preparation in advance.

Post Verification Case 5

AIFTAOverview

- FTA Agreement

- AIFTA

- Import duty

- 15% (MFN) / 5%(FTA)

- Counterparty Country

- India

- HS CODE

- 8708.99

- Item Description

- High-pressure pipe for automotive

- PSR

- CTSH + RVC35%

- Issues

- Suspected non-compliance with HS code and origin criteria

Transaction

Issues on Workflow

Post verification preparedness methods

- Accurate HS Code classification on automotive parts

-

For automotive parts, precise classification is required.

This is because the classification of automotive parts can vary significantly depending on factors such as their installation position or whether they are specifically covered under another heading.

- Special attention when using RVC criterion

-

When determining RVC under the agreement, special attention must be paid to

the trends in purchase and sales price fluctuations.

The validity of the manufacturer’s declaration must be verified, and the manufacturer’s declaration should be retained to prepare for potential post-verification.

Implications

Due to the nature of processing in the automotive industry, which involves multiple suppliers, it is important to request prompt updates of documentation to ensure timely responses.

In the case of AIFTA, where a mixed verification approach is used, if the requirements are not met through indirect verification, direct verification may be conducted. Therefore, it is crucial to maintain proper documentation to support claims during indirect verification