Overview of Approved Exporters (AE)

- PH-EFTA FTA

Approved Exporter - EU REX

Registered exporter - RCEP

Approved exporter - ASEAN-wide Self-Certification

Scheme (AWSC)

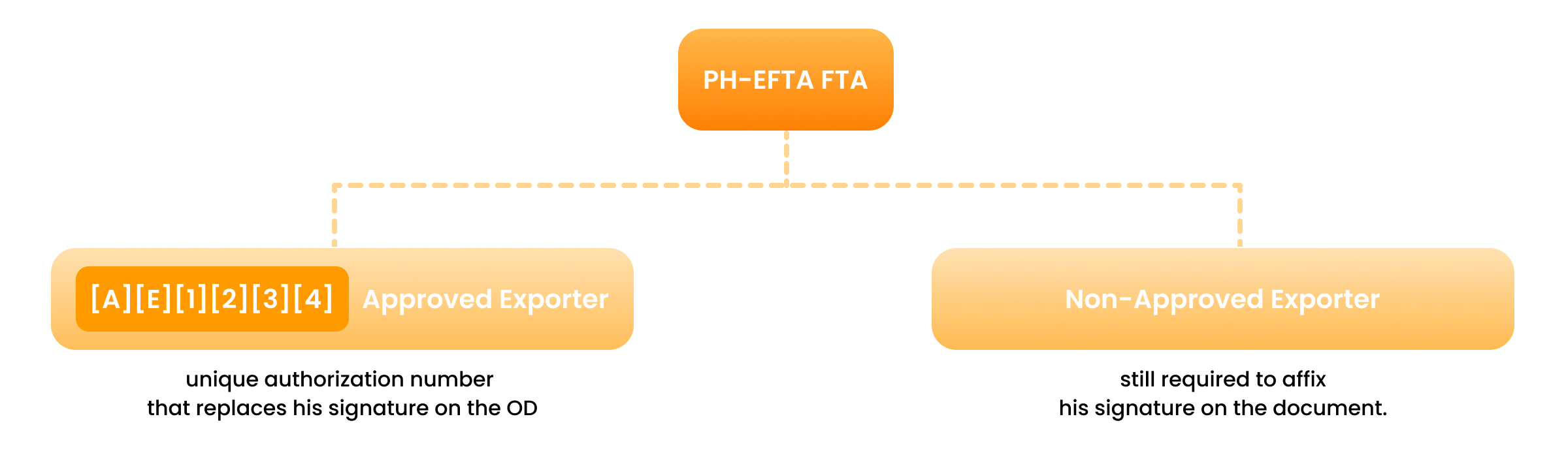

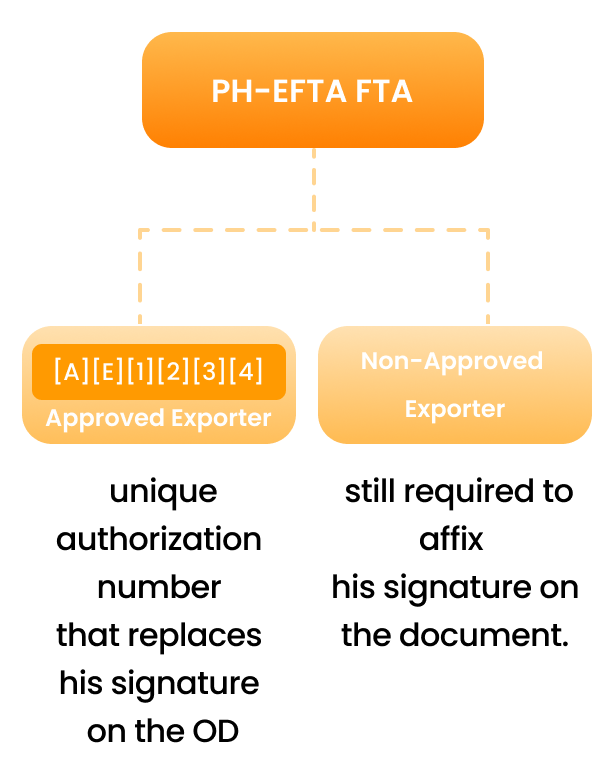

What is PH-EFTA FTA?

Application for Philippine Approved Exporters under PH-EFTA FTA

The complete guidelines on the implementation of the PH-EFTA FTA, as specified in Customs Memorandum Order 14-2018.

Latest Income Tax Return

Unique Reference Number (URN) as PEZA Locators and Client Profile Registration System (CPRS) for Non-PEZA Locators

Business Permit/s

SEC/DTI registration, which is applicable

Product Evaluation Report, if applicable

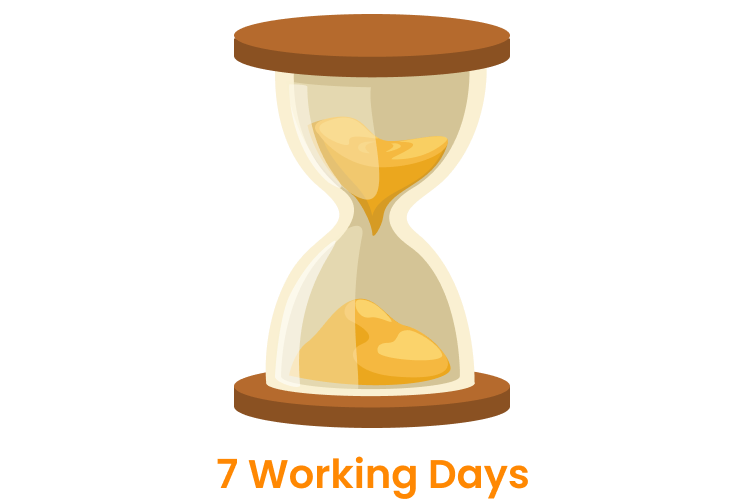

Exporters shall be notified about the result of evaluation. Approved Exporters shall be assigned with a Customs Authorization Number within seven (7) working days after receipt of the complete set of documents by ECD.

What is Registered Exporter System (REX)?

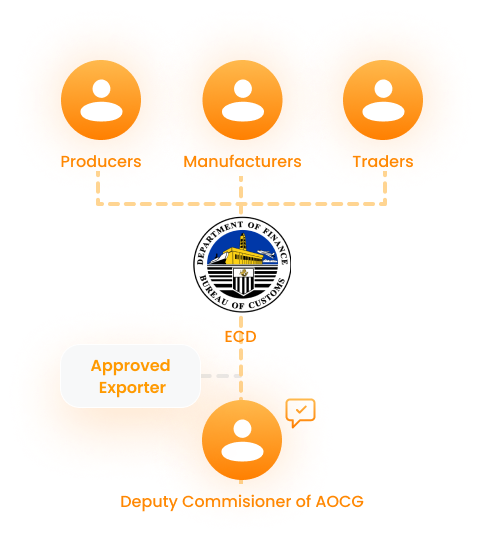

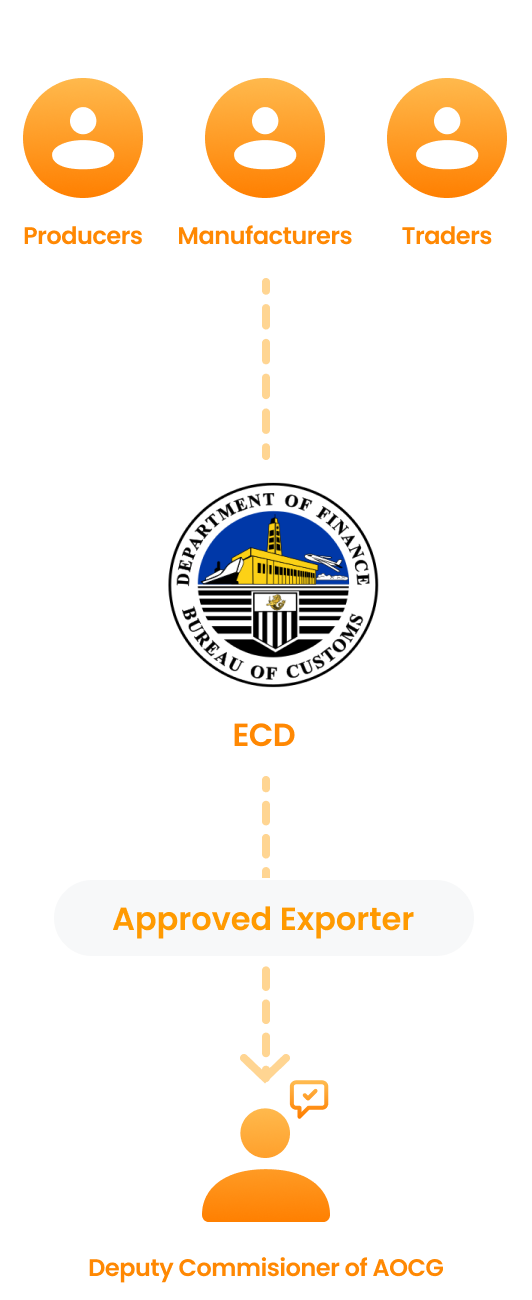

Registered Exporter It shall refer to a producer, manufacturer or trader who complied with the EU and authorized by the Bureau to complete a Statement of Origin through invoice or any other commercial document.

Producers, manufacturers, or traders may apply to be a “Registered Exporter” by filling out the application at https://customs.ec.europa.eu/rex-pa-ui/#/create-preapplication/.

- Documents

-

Unique Reference Number (URN) as PEZA Locators, Client Profile

Registration System (CPRS) for non-PEZA Locators or other equivalent

document;

Product Evaluation Report (PER), if applicable.

ECD shall notify the Exporters and the endorsing port on the result of the application with the assigned REX Number. Denial of application shall be communicated stating the reasons therein.

Representative/s of an exporter shall be allowed to make origin declaration upon submission of the exporter’s written authorization.

What is RCEP Approved Exporter?

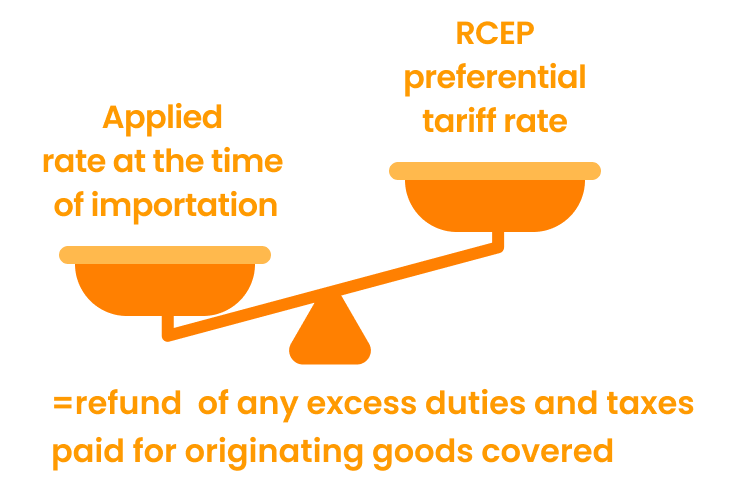

Originating goods shall be eligible for RCEP preferential tariff treatment at the time of importation pursuant to Executive Order (EO) No. 25, series of 2023. The applicable RCEP preferential tariff rate shall be determined based on the RCEP Country of Origin of the originating goods in accordance with Section 5.7.

Declaration of Origin

The complete guidelines on the implementation of the RCEP Agreement is specified in Customs Memorandum Order 12-2023.

What is ASEAN-wide Self-Certification Scheme (AWSC)?

-

AWSC (ATIGA)The Philippines, together with the other nine (9) ASEAN Member States, has begun to implement the ASEAN-Wide Self-Certification Scheme (AWSC) starting 20 September 2020.

-

AWSC (ATIGA) ➝ Duty free lower duties

The Philippines, together with the other nine (9) ASEAN Member States, has begun to implement the ASEAN-Wide Self-Certification Scheme (AWSC) starting 20 September 2020.

-

BOC ➝ ATIGA Own origin declration

Philippine exporters may apply for Certified Exporter status with the Bureau of Customs (BOC). Once granted, they can begin issuing their own origin declaration, which will be used by importers when claiming ATIGA preferential tariffs. The implementation guidelines are set out in the BOC Customs Memorandum Order (CMO) No. 24-2020.

-

Certificate of Origin ➝ must apply BOC

With the AWSC, it will be easier for MSMEs to maximize the use of ATIGA and benefit substantially from the ASEAN Free Trade Agreement (FTA). This is especially important in the current situation as this removes the step where companies must apply for a Certificate of Origin with the BOC for each of their shipments.

-

Finally...

The AWSC is expected to significantly minimize burdens associated with administrative compliance and decrease transaction costs related to origin certification procedures. Compared to the usual practice where exporters apply to the BOC for Certificates of Origin for every shipment, this scheme removes the step of having to repeatedly transact with Customs. As it is easier to certify a product’s origin, it is envisaged to increase the utilization of the ATIGA and subsequently, further increase the competitiveness of Philippine exports to ASEAN.

Guidelines in the Implementation of the ASEAN Wide

Self-Certification

Scheme (CMO No. 24-2020)

- General Provisions

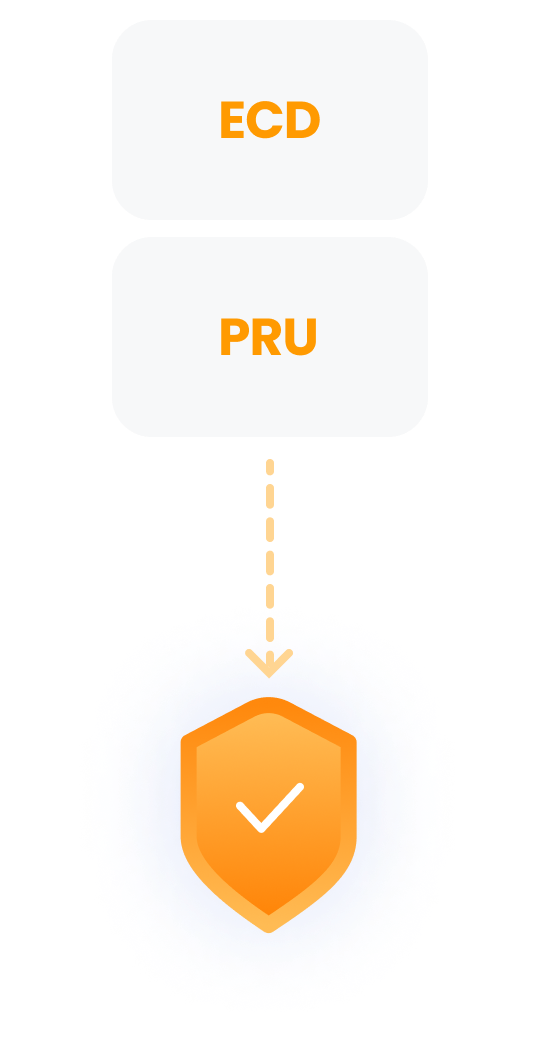

- Guidelines in the Implementation of the The AOCG, through the ECD, shall carry-out proper examination of the application for Certified Exporter status as provided under Section 5.1 of the CMO. They shall also have the right to request for additional supporting documentary evidence, as necessary.

The AOCG, through the ECD, shall maintain a Philippine AWSC database and monitor all Philippine Certified Exporters relative to their compliance with laws, rules and regulations pertinent to exportation and Rules of Origin.

- ECD

- The ECD, through the Export Divisions (ED) or its equivalent, shall monitor the proper use of the authorization, including verification of the correctness or authenticity of Origin Declarations made out by Philippine Certified Exporters. Furthermore, the ECD or its equivalent unit, shall act on retrospective verification requests by the Customs Authorities of the Importing AMS on Origin Declarations made out by Philippine Certified Exporters in conformity with Rule 18 ( Retroactive Check) of Annex 8 ( Operational Certification Procedures) of ATIGA.

- PRU

-

The PRU shall evaluate the authenticity and validity of the Origin

Declaration submitted by importers and grant ATIGA preferential tariff

rates accordingly.

The PRU, through the ECD, may request for verification when it has reasonable doubt as to the authenticity of the Origin Declaration made out by Certified Exporters of other AMS or as to the accuracy of the information regarding the origin of the goods or of certain parts thereof.

The PRU or its equivalent units in all ports shall be provided access to view all Certified Exporters registered in ASEAN AWSC database.

- AOCG

- The AOCG shall coordinate with the Management Information and Systems Technology Group on the information and communication technology requirement with regard to the implementation of this order.