Overview of ACFTA Case Model

China is the region’s largest trading partner. Trade between ASEAN and China reached US$280 billion in 2011, representing 11.7% of ASEAN's total trade.

The main attraction of ACFTA is that it provides enormous opportunities and benefits to consumers and businesses in member countries.

- Consumer Benefits

- Consumers benefit by having access to a variety of affordable products and agricultural products.

- Firm Benefits

- In particular, many ASEAN companies can more easily enter the Chinese market, the world's fastest growing market.

- Production Efficiency

- Tariff elimination also allows for a freer flow of intermediate goods between the two regions, benefiting producers at all stages of production.

- Economic Integration

- Deepen regional economic integration. Given the increased significance of production fragmentation in both regions, it is useful to examine more closely how a free trade agreement will ultimately reshape production and trade relations between China and ASEAN countries.

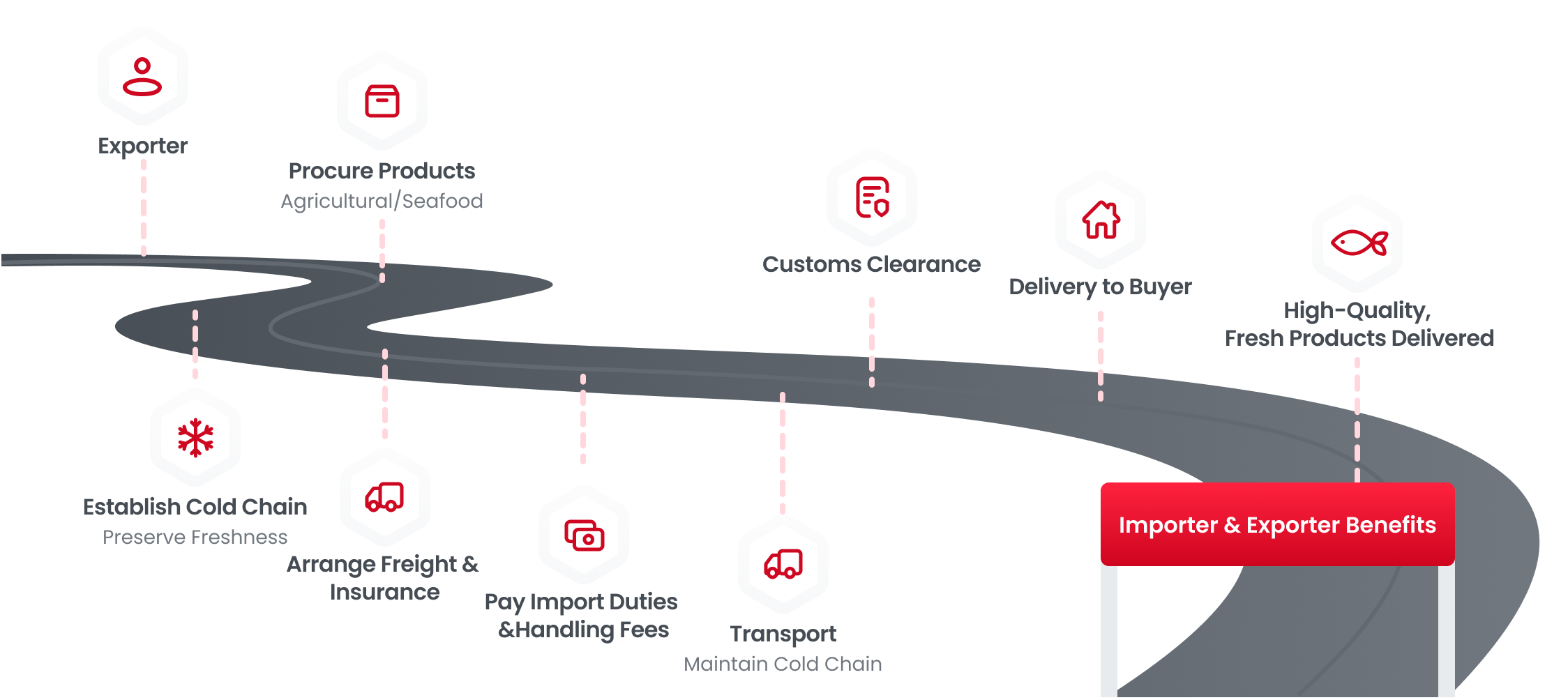

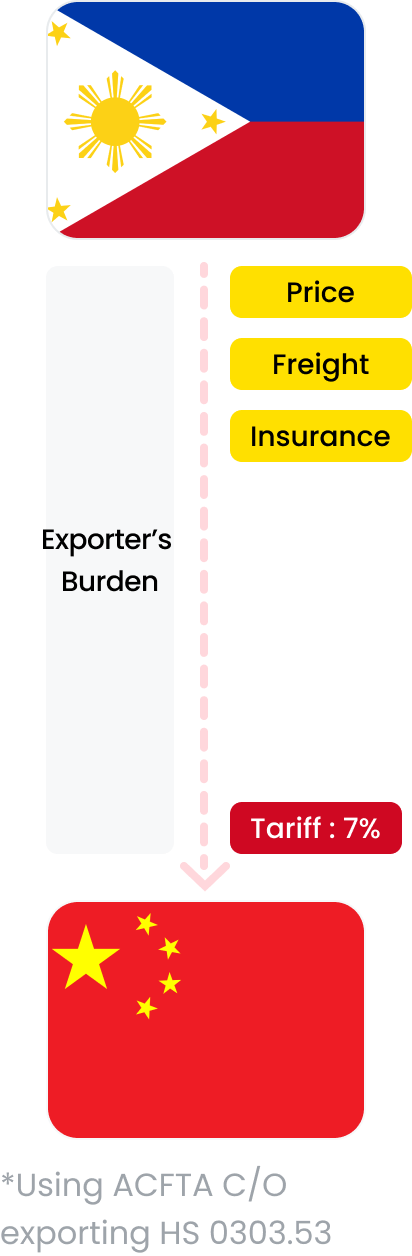

Exporting model for Primary products using DDP Term

What is DDP term?

What is the relationship between the DDP and FTA?

Using DDP terms allows exporters to increase the contract price while simultaneously leveraging FTAs to reduce import duty burdens

- Quality Assurance

- By assuming responsibility for delivery up to the buyer's location under DDP terms, exporters can ensure that the cold chain is maintained effectively, thus preserving the quality and freshness of the seafood.

- Market Competitiveness

- Offering DDP terms can attract buyers by providing a hassle-free delivery experience and eliminating uncertainties related to customs clearance and duty payment, thereby enhancing competitiveness in international markets.

- Risk Mitigation

- DDP terms shift the risk of transportation and customs clearance to the exporter, reducing potential delays or issues at the destination. This can lead to smoother transactions and enhanced customer satisfaction.

In summary, integrating DDP terms with a maintained cold chain ensures that exporters can deliver high-quality seafood while also offering logistical and financial benefits that appeal to international buyers.

Case Model utilizing DDP term and cold chain

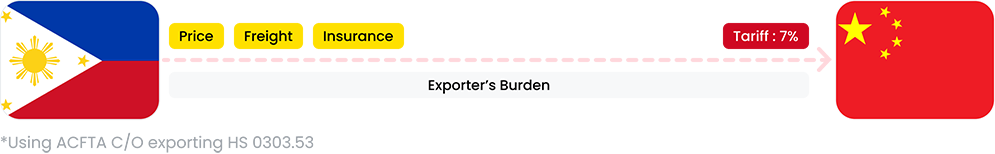

Under DDP (Delivered Duty Paid) terms, exporters typically bear the responsibility not only for freight and insurance costs but also for import duties, leading to an increase in the contract price. Especially when exporting primary products like agricultural or seafood products, maintaining freshness often necessitates exporters utilizing DDP (Delivered Duty Paid) terms to procure and maintain a cold chain.

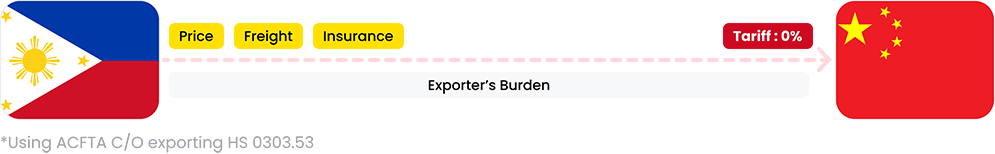

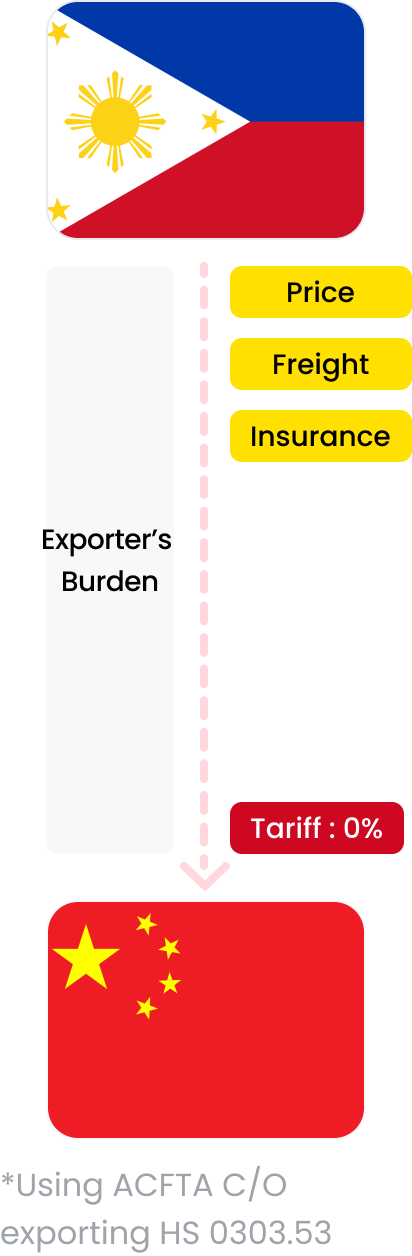

When changing trade terms from CIF to DDP, the exporter assumes responsibility for customs duties and handling fees, potentially increasing the contract price. However, if benefiting from a 0% preferential tariff rate under an FTA, the importer faces no import duty burden, reducing actual costs for the exporter despite the higher contract price.

Before Utilizing FTA

After Utilizing FTA