Overview of the EU-GSP + Case Model

This case model aims to establish production bases in the Philippines and export products manufactured in the Philippines to the European Union (EU), leveraging the Generalized Scheme of Preferences Plus (GSP+) agreement to maximize tax benefits. Specifically, it allows Chinese companies to avoid the high base tariffs when exporting to the EU and instead benefit from lower tariffs through the Philippines.

Market Analysis

The Philippines offers the opportunity to export various products at reduced tariffs through the GSP+ agreement with the EU. This enhances the price competitiveness of products manufactured in the Philippines.

China does not have a free trade agreement (FTA) with the EU, resulting in the application of basic tariffs. Therefore, Chinese companies need to utilize the Philippines to reduce their tax burdens.

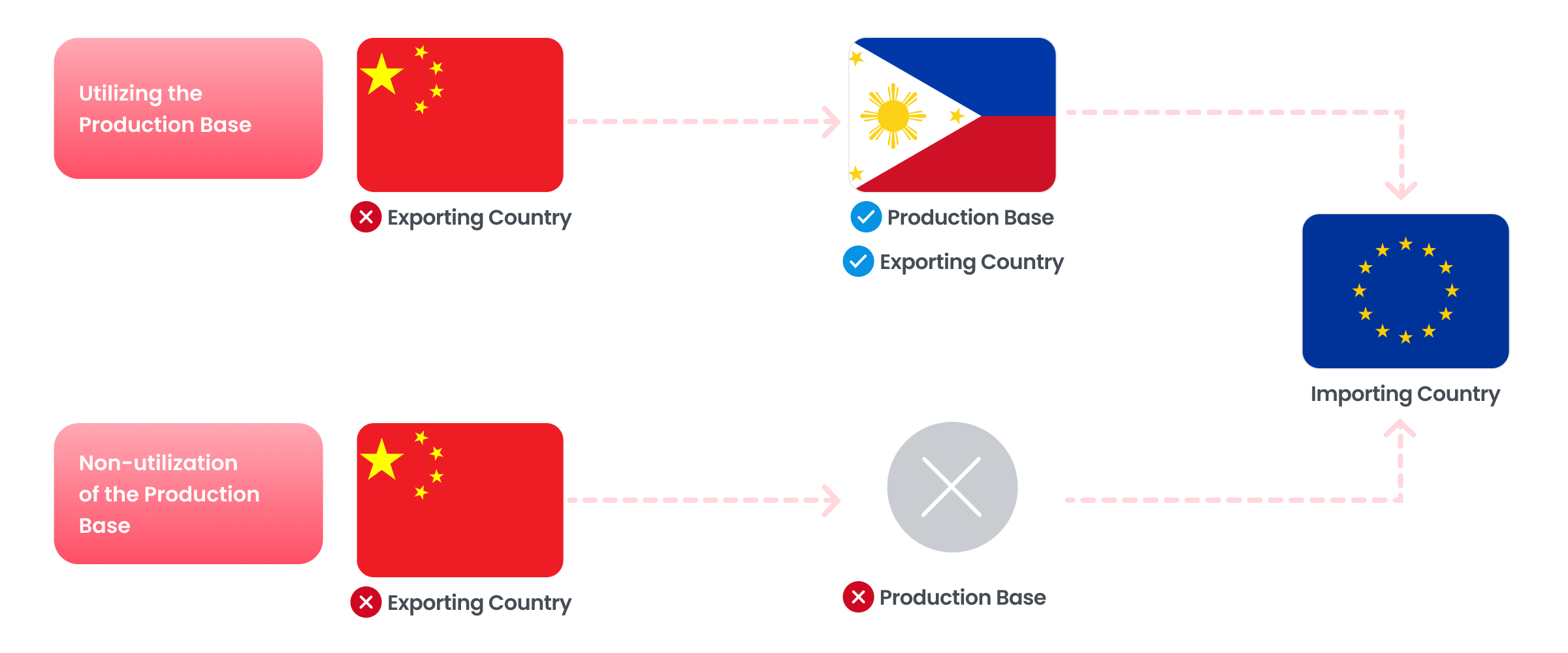

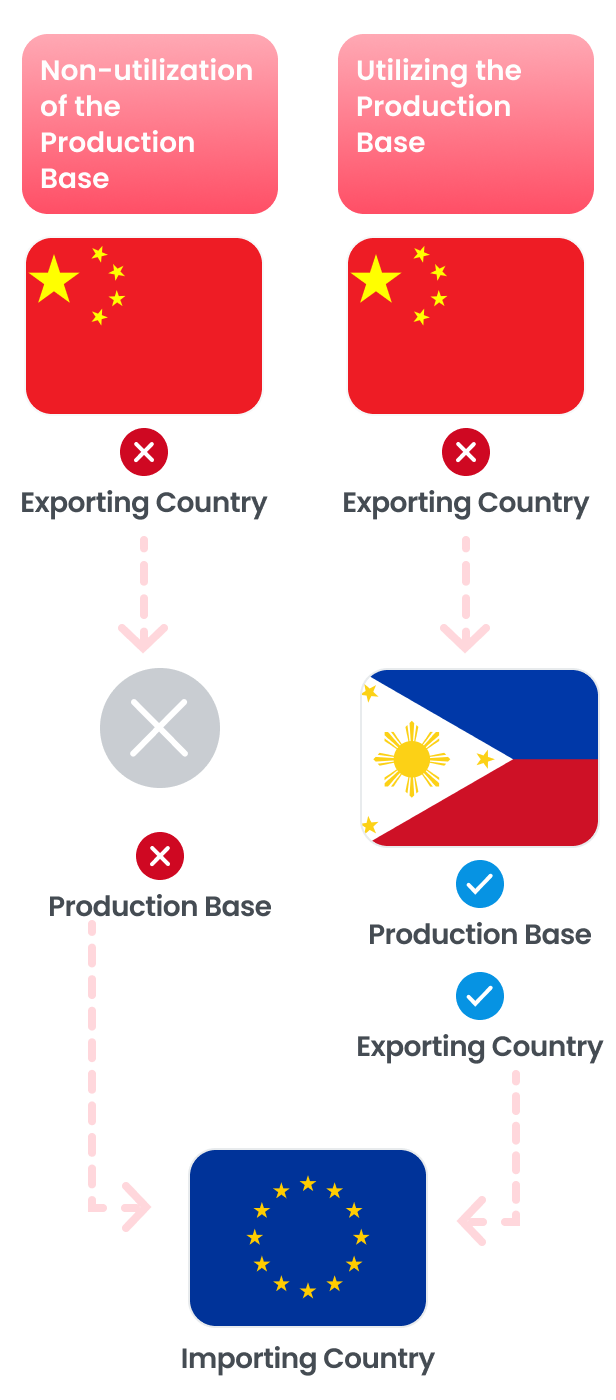

EU-GSP+ Case Model

This case model aims to establish production bases in the Philippines and export products manufactured in the Philippines to the European Union (EU), leveraging the Generalized Scheme of Preferences Plus (GSP+) agreement to maximize tax benefits. Specifically, it allows Chinese companies to avoid the high base tariffs when exporting to the EU and instead benefit from lower tariffs through the Philippines.

Chinese companies will set up manufacturing facilities in the Philippines to reduce production costs and produce goods locally.

Implement a rigorous quality management system to ensure products meet EU quality standards.

Develop an efficient logistics system for exporting products from the Philippines to the EU, optimizing maritime transport and customs.

Revenue Model 1

By exporting products manufactured in the Philippines to the EU under the GSP+ tariff, companies can reduce tax burdens and reflect these savings in pricing to enhance competitiveness.

Revenue Model 2

Establish a diverse range of product lines that can be manufactured in the Philippines to secure multiple revenue sources.

Case Model Diagram

Example Products for the Case Model

[Model 1] Automotive Parts HS 8708.99

| Category | Basic rate | GSP+ rate | Utilization of the Production Base |

|---|---|---|---|

| Export from China |

3.5% | Non-application | no |

| Export from the Philippines |

12% | 0% | yes |

[Model 2] Cashmere Cardigan HS 6110.12

| Category | Basic rate | GSP+ rate | Utilization of the Production Base |

|---|---|---|---|

| Export from China |

12% | Non-application | no |

| Export from the Philippines |

12% | 0% | yes |

[Model 3] Dried Pineapples HS 0804.30

| Category | Basic rate | GSP+ rate | Utilization of the Production Base |

|---|---|---|---|

| Export from China |

5.8% | Non-application | no |

| Export from the Philippines |

5.8% | 0% | yes |