Overview of the UK-DCTS Case Model

Overview of the UK's Developing Countries Trading Scheme (DCTS)

The UK's Developing Countries Trading Scheme (DCTS) is a trade policy established to support the economic development of developing countries. This scheme is one of the important policies that promotes economic self-reliance and global economic integration of developing countries, and plays an important role in the UK's trade policy.

The main contents of the UK's DCTS are as follows:

The primary goal of the DCTS is to promote economic development in developing countries by providing them with fair trade opportunities. This scheme aims to help these countries boost their exports and achieve greater economic self-sufficiency.

Under the DCTS, goods imported from developing countries benefit from reduced or eliminated tariffs. This helps these countries' products gain easier access to the UK market.

The primary goal of the DCTS is to promote economic development in developing countries by providing them with fair trade opportunities. This scheme aims to help these countries boost their exports and achieve greater economic self-sufficiency.

The DCTS aims to reduce trade barriers for developing countries, facilitate their integration into the global economy, and address international economic imbalances.

Applying tax rates according to HS CODE

There are various types of tariff rates that may be applied under the DCTS, examples of which are as follows:

Ad-valorem tariffs

Most tariffs under the DCTS are ad-valorem tariffs, which are a percentage of the product's total customs value.

Specific tariffs

Specific tariffs are fixed charges applied per unit of a product, based on criteria such as weight, volume, or number of items.

Compound tariffs

Compound tariffs are a combination of ad-valorem tariffs and specific tariffs.

Seasonal tariffs

Seasonal tariffs are tariffs that change depending on the time of the year.

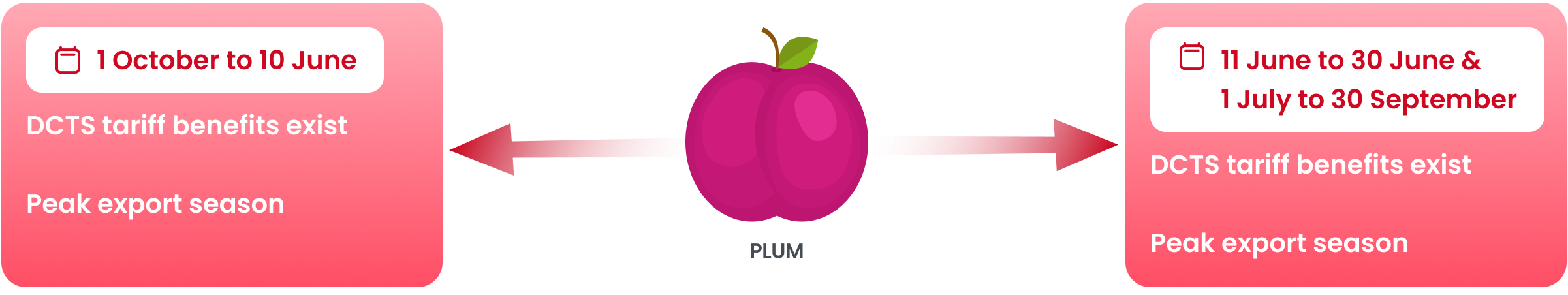

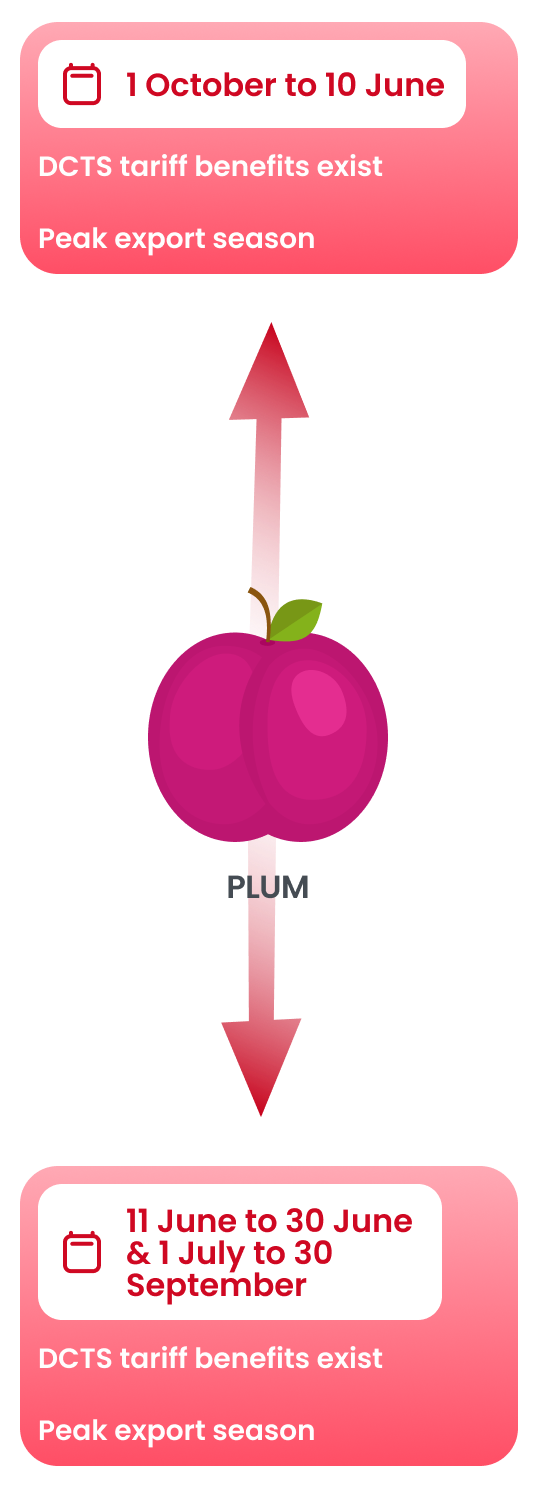

Case model utilizing seasonal tariffs

Among the goods exported to the United Kingdom, Plums classified under heading 0809.40-0500 are subject to seasonal tariffs, with different tariff rates applied depending on the period.

Commodity code 0809.40-0500

Timeline 1 October to 10 June

Basic tariff 2.5%

DCTS tariff 0%

DCTS tariff benefits 2.5%

Timeline 11 June to 30 June

Basic tariff 6%

DCTS tariff 6%

DCTS tariff benefits X

Timeline 1 July to 30 September

Basic tariff 12%

DCTS tariff 12%

DCTS tariff benefits X