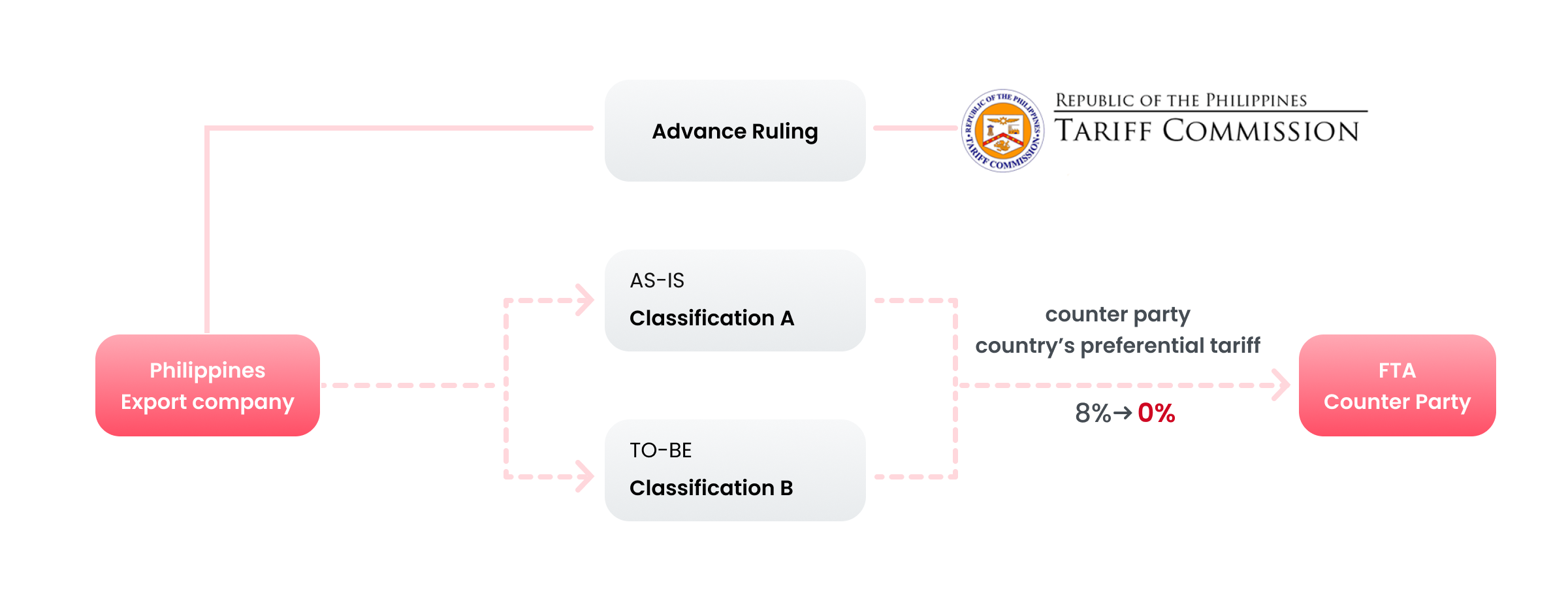

Export support model through advance ruling of item classification

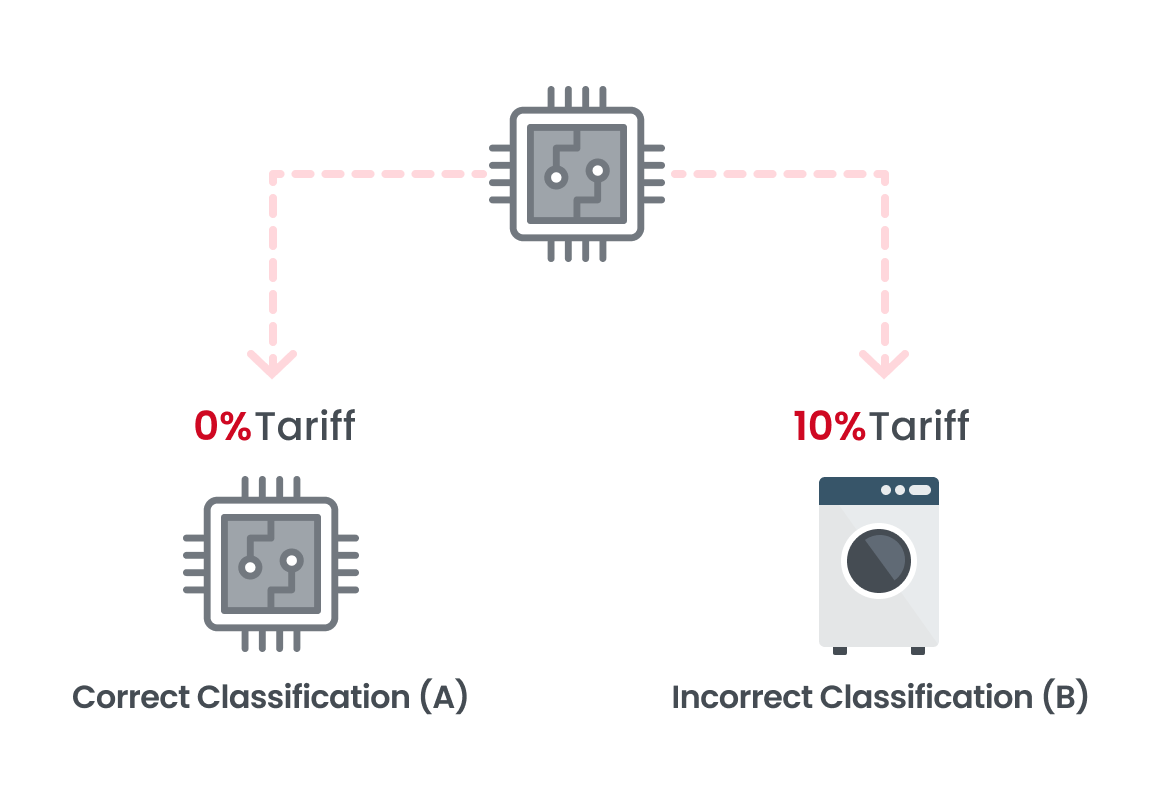

Many companies are unable to enjoy FTA benefits due to incorrect product classification:

Example

Accurate product classification A (counter party country's preferential tariff

: 0%), Incorrect product classification B (counter party country's preferential tariff :

10%)

2. Companies that have traditionally classified their products as B → Provided with consulting services → Supported to reclassify their products as A for export.

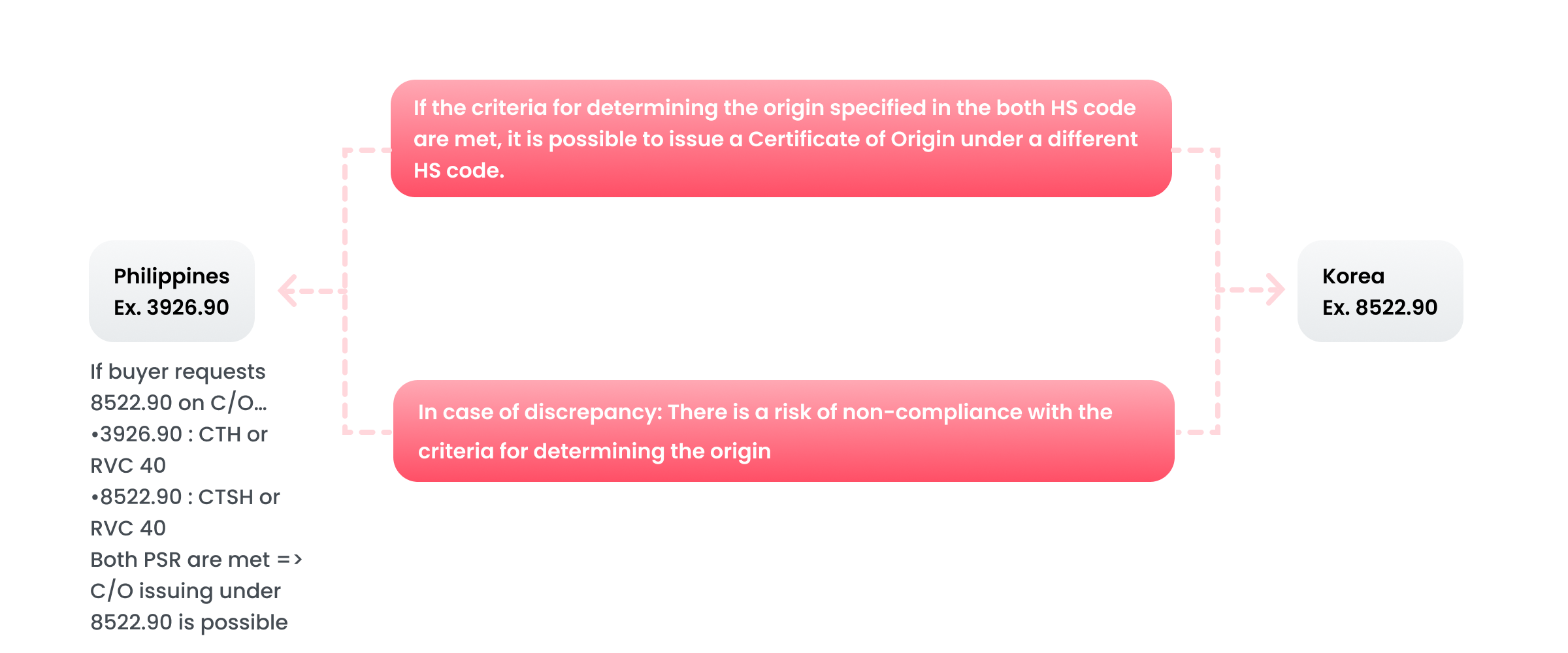

Certificate of Origin issuance utilizing

the desired HS code

requested by the importing country

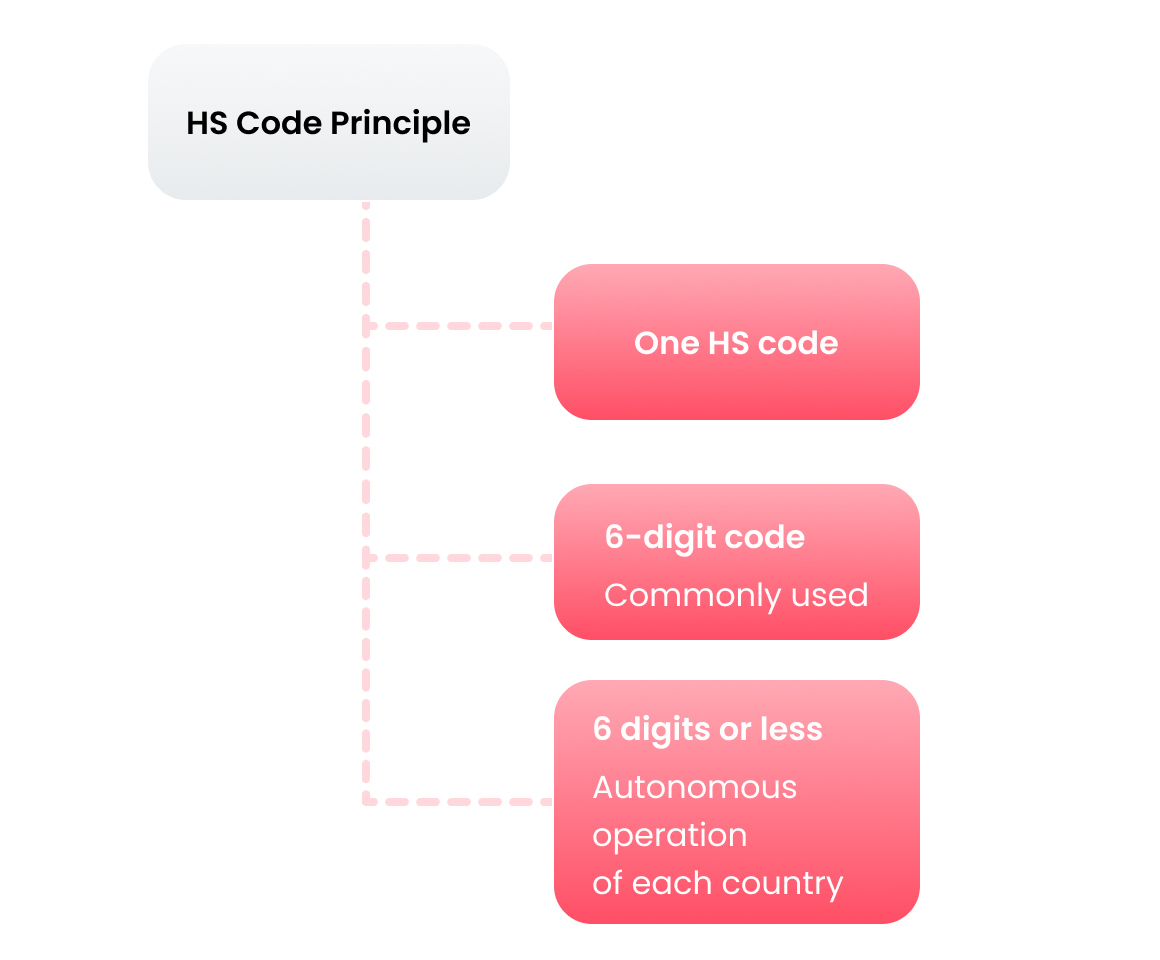

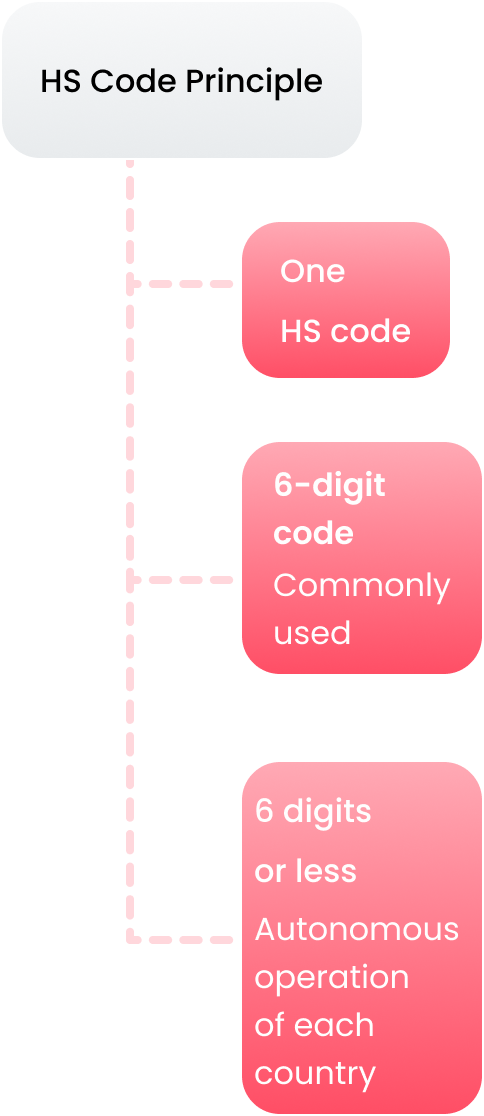

The principle of the Harmonized System (HS) Code dictates that one item should be classified under one HS code.

Therefore, among the contracting parties of the HS Convention, the 6-digit HS code is commonly used, while below the 6-digit level, each contracting party operates autonomously.

However, practical issues arise in the field due to differences in interpretation of product classification between contracting parties, leading to variations in HS codes.

In cases where such documentation is verifiable, issuance of a Certificate of Origin under the HS code requested by the importing country is possible.

But The determination of origin must be conducted for both the HS code used for exporting from the Philippines and the HS code requested by the importing country.