Overview of ATIGA Case Model

The ASEAN Trade in Goods Agreement (ATIGA) is designed to facilitate trade among the member countries of the Association of Southeast Asian Nations (ASEAN). It offers several key benefits, which include:

- Enhanced Market Access

- ATIGA aims to eliminate tariffs and reduce non-tariff barriers, making it easier for businesses to access markets within the ASEAN region.

- Increased Trade Efficiency

- The agreement simplifies and harmonizes trade procedures, reducing the time and cost involved in cross-border trade.

- Economic Integration

- By fostering a more integrated regional market, ATIGA promotes economic cooperation and development among ASEAN member states.

- Competitiveness

Improvement - The agreement helps businesses become more competitive by providing a larger market and creating opportunities for economies of scale.

- Standardization and Quality

Improvement - The agreement encourages the adoption of international standards and best practices, improving the quality of goods traded within the region.

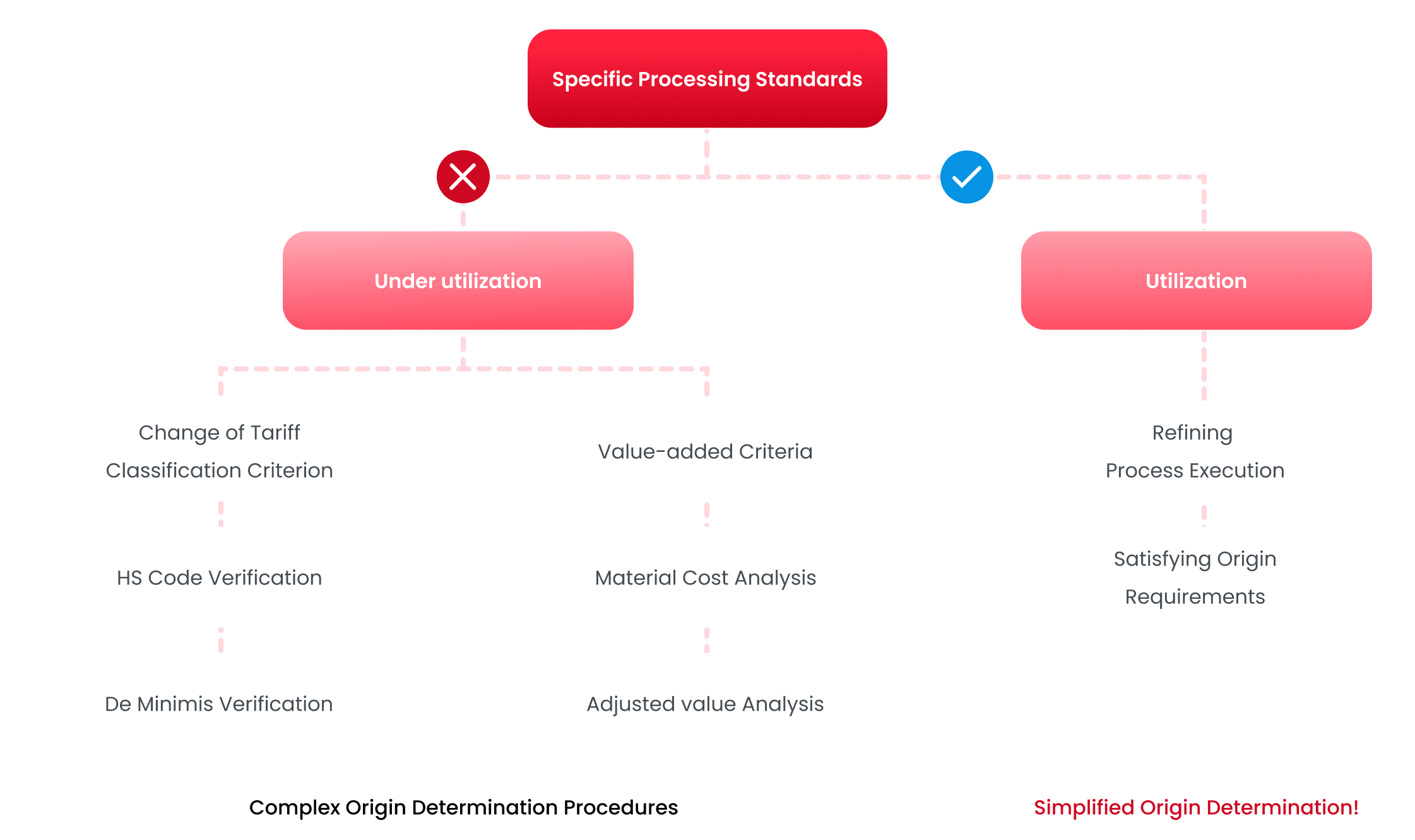

Case Model Utilizing Specific Processing Standards for FTA

The specific processing criterion is a product-specific rule of origin that is easier and more efficient for origin management compared to the change in tariff classification or value-added criteria. Each agreement regulates product-specific rules of origin differently.

-

Animal and Vegetable Oils

-

Margarine

-

Fish Oil

Under ATIGA, most products classified under Chapter 15, "Animal, vegetable or microbial fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes," are governed by specific processing criteria. Therefore, if a product is produced through refining, there is no need to manage the complex details of the tariff classification or the level of value addition of the raw materials. Only the specific process needs to be proven, making origin management more convenient.

For goods classified under Chapter 15, specifically subheading 1515.90 (Other Vegetable Oils), the ASEAN country-FTA tariffs and Product Specific Rules (PSR) under various FTA agreements that ASEAN countries are parties to are as follows:

Tariff Rate for Heading 1515.11 Other Vegetable Oils

Philippines

Philippines

-

3%

Basic

Tariff -

0%

ATIGA

Tariff

Laos

Laos

-

10%

Basic

Tariff -

1%

ATIGA

Tariff

Vietnam

Vietnam

-

25%

Basic

Tariff -

5%

ATIGA

Tariff

Myanmar

Myanmar

-

15%

Basic

Tariff -

0%

ATIGA

Tariff

Singapore

Singapore

-

0%

Basic

Tariff -

0%

ATIGA

Tariff

Malaysia

Malaysia

-

0%

Basic

Tariff -

0%

ATIGA

Tariff

Indonesia

Indonesia

-

5%

Basic

Tariff -

0%

ATIGA

Tariff

Brunei

Brunei

-

0%

Basic

Tariff -

0%

ATIGA

Tariff

Cambodia

Cambodia

-

7%

Basic

Tariff -

0%

ATIGA

Tariff

Thailand

Thailand

-

10%

Basic

Tariff -

0%

ATIGA

Tariff

PSR by Agreement for Heading 1515.90 Other Vegetable Oils

-

ATIGA

PSR RVC(40) CC SP

-

AANZFTA

PSR RVC(40) CC SP

-

ACFTA

PSR RVC(40) CTH

-

AHKFTA

PSR PE WO RVC(40)

-

AIFTA

PSR RVC(35) CTH

-

AJCEPA

PSR CC

-

AKFTA

PSR RVC(35) CTSH

-

RCEP

PSR CC

*AANZFTA also allows the application of SP criteria

SP Criteria of ATIGA

No change in tariff classification is required, provided that the good is produced by refining