What is an Advance Ruling System?

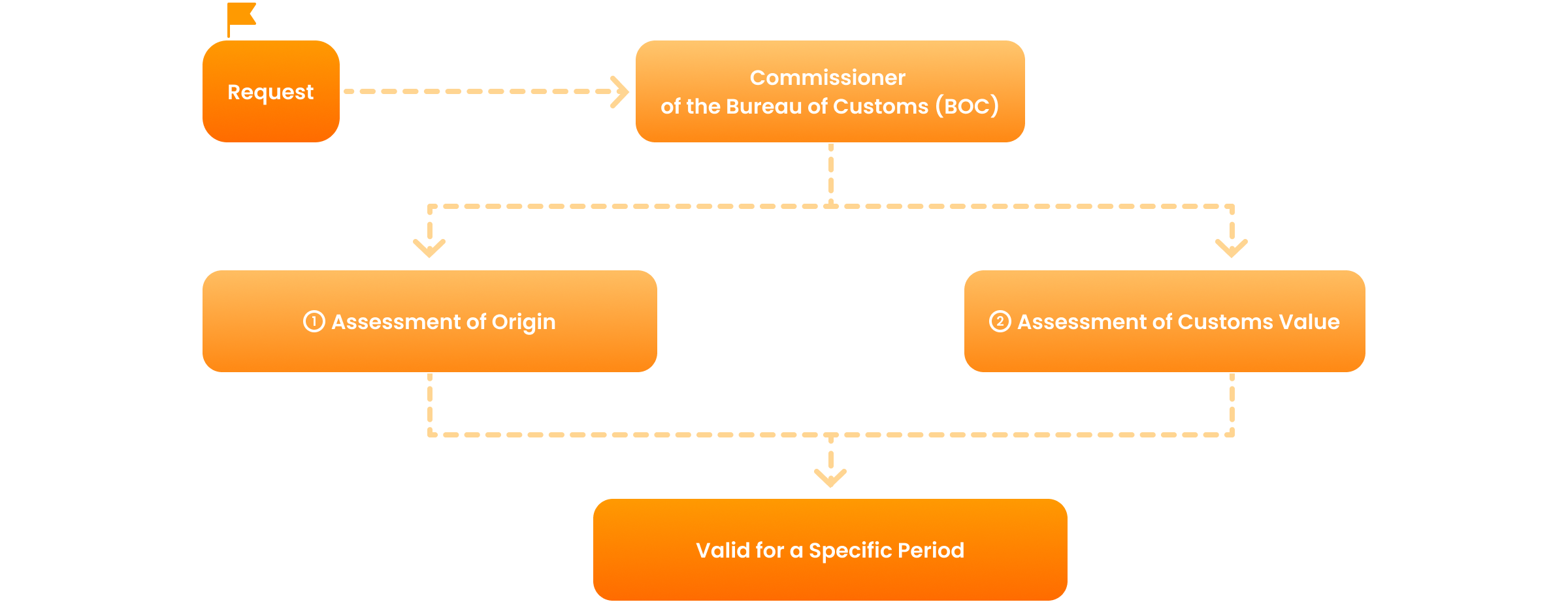

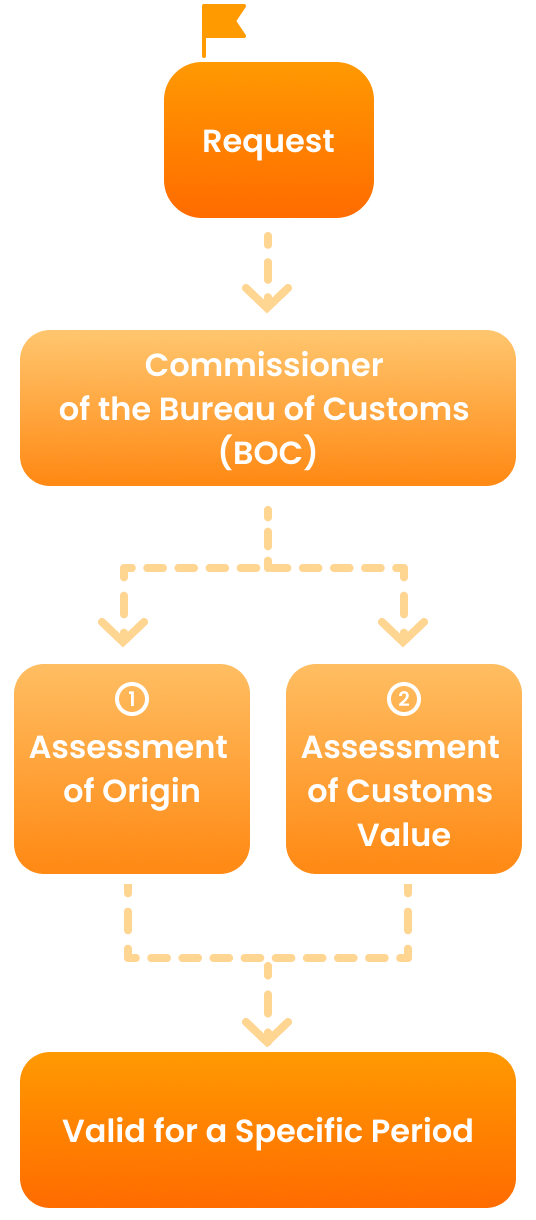

An official written and binding ruling issued by the Commissioner of the Bureau of Customs (BOC) which provides the Requesting Person with an assessment of :

Who may request for Issuance of Advance Ruling?

Importer or Foreign Exporter or its authorized agent may request an Advance Ruling.

Requirements for Requesting an Advance Ruling

Withdrawal of Request

Expressly at the instance of the Requesting Person at any time before an Advance Ruling is issued.

Revalidation of Advance Ruling

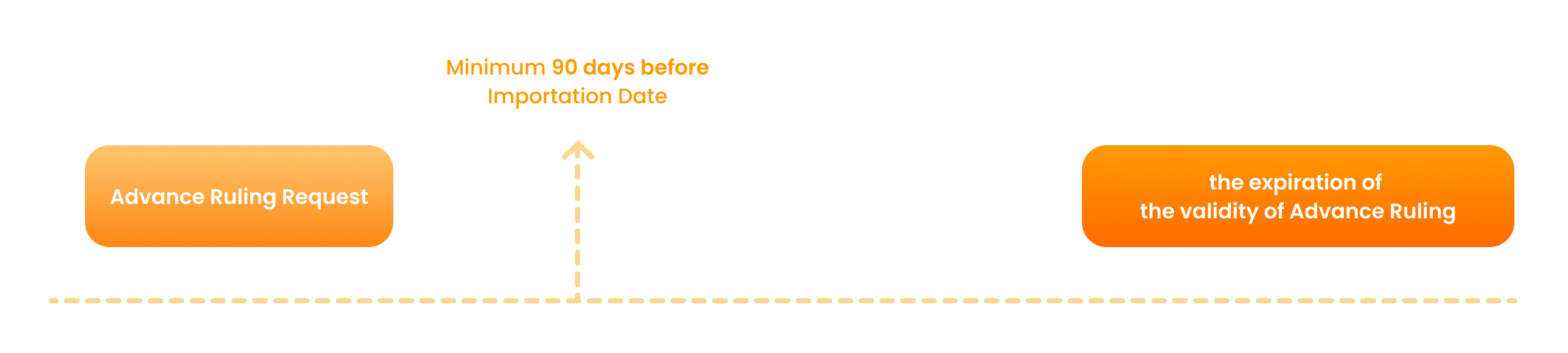

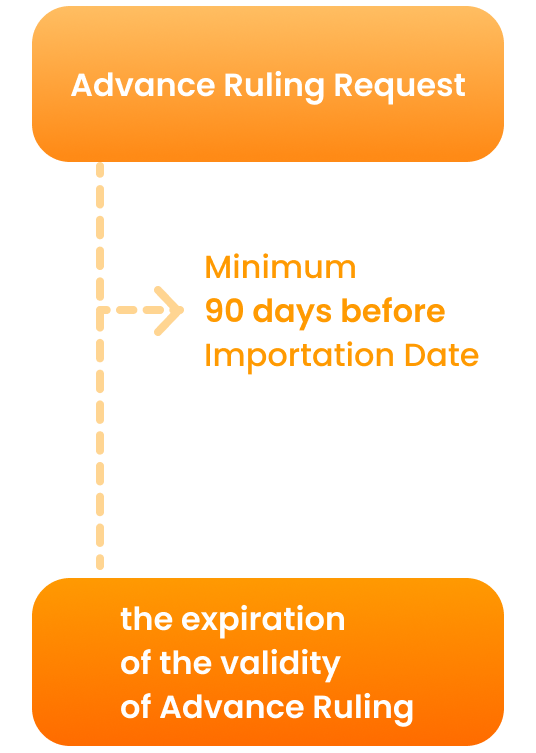

Period to Issue Advance Ruling and its Revalidation

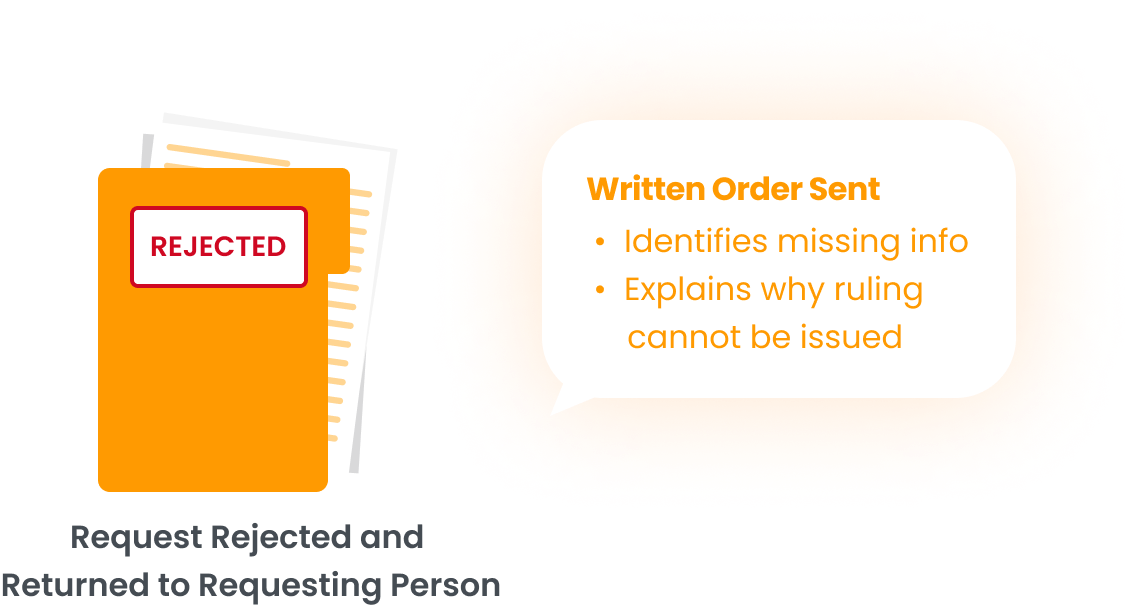

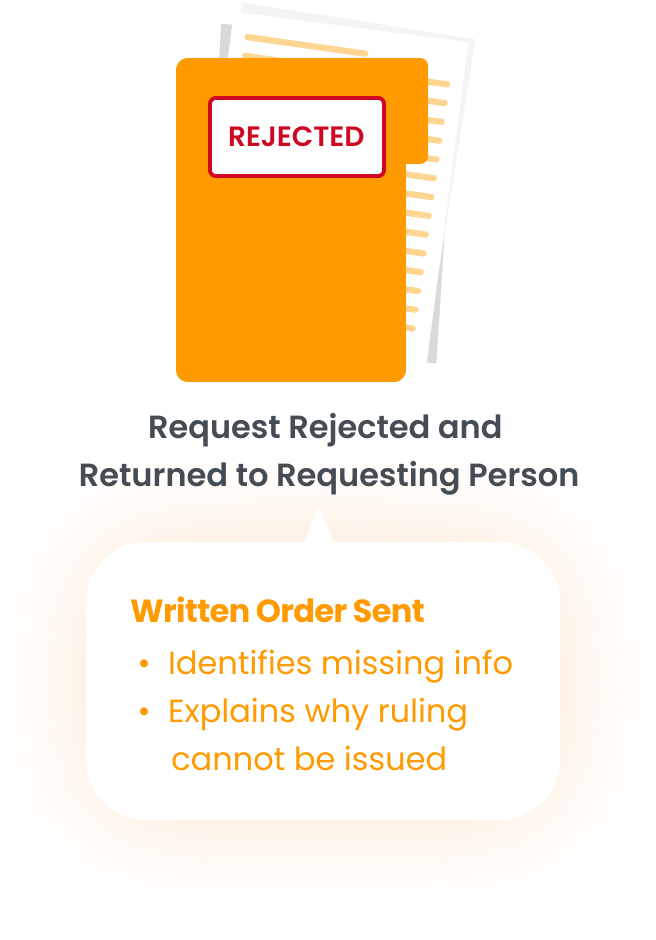

Grounds for Declining

The Issuance of an Advance Ruling may be declined in the following cases:

- The issue involves a matter that is before the court or is the subject of an administrative review, or under post clearance audit

- A request for Advance Ruling on the same goods is already filed by the same Requesting Party, however an earlier request filed by an agent shall be declined if a latter request is filed by the principal

- An Advance Ruling on the same goods has been issued to the same Requesting Person

- The request is based on hypothetical situation.

In all cases, if the issuance of an Advance Ruling is declined, the Bureau shall promptly notify the Requesting Person in writing through electronic means clearly stating the reason for such.

Binding Effect and Period of Effectivity of an Advance Ruling

Modification, Revocation or Invalidation of an Advance Ruling

Advance Rulings may be modified based on the following grounds:

Revocation or Invalidation of an Advance Ruling

An Advance Ruling may be revoked or invalidated upon discovery that the applicant submitted incomplete, incorrect, false or misleading information.

Revocation or invalidation of Advance Rulings shall be retroactive.

- Notification

- Where the Advance Ruling is modified, revoked or invalidated, the Bureau shall give written notice to the Requesting Person, setting out the relevant facts and the basis for its decision.

Appellate Remedy

Within fifteen (15) calendar days from receiving the Ruling or decision, the Requesting Person can file a motion for reconsideration with the Bureau.

If the motion for reconsideration is denied, the Requesting Person has thirty (30) calendar days from receiving the denial to appeal the adverse ruling to the Court of Tax Appeals.