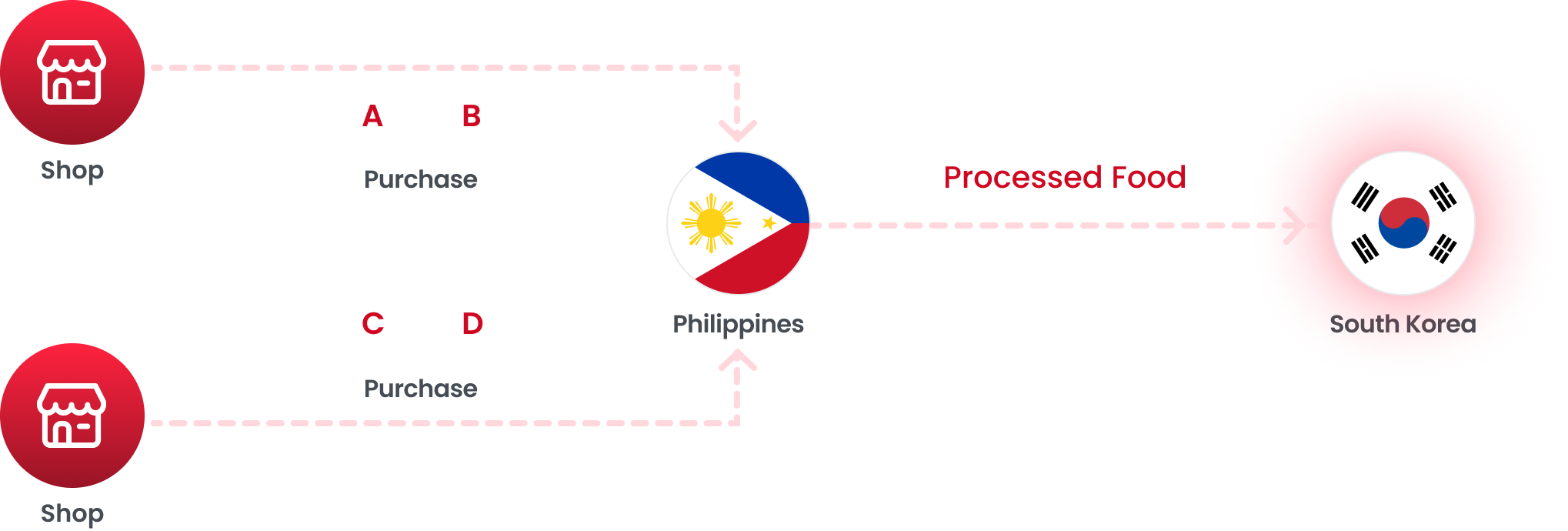

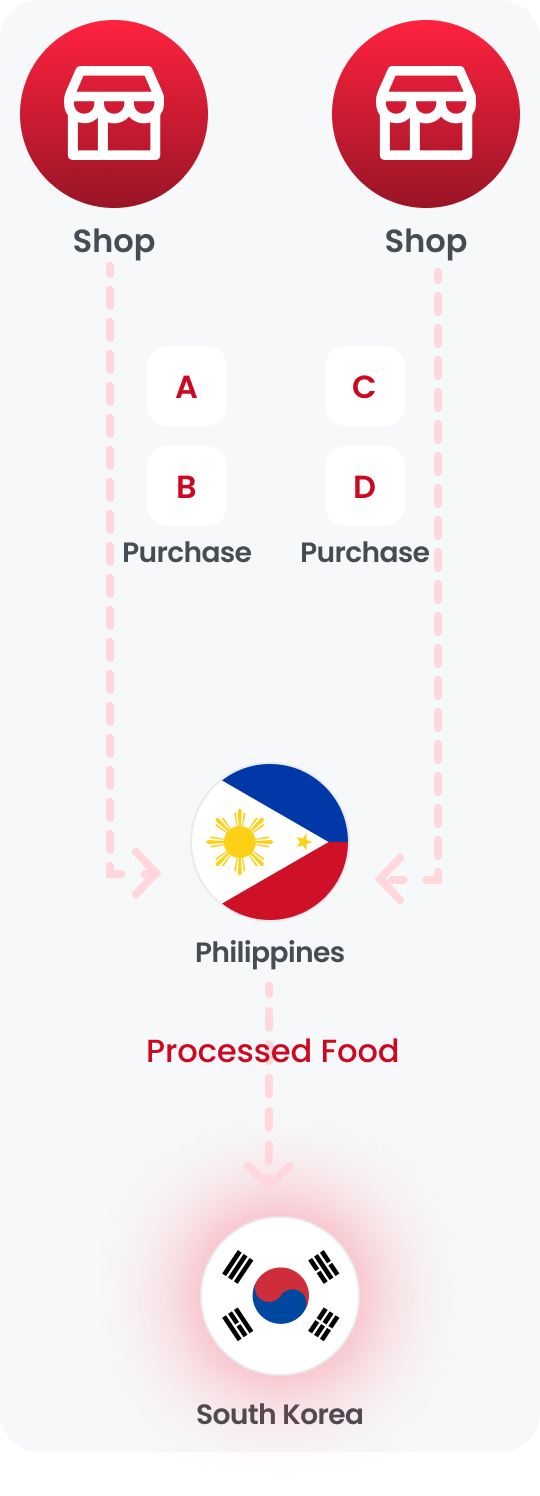

Case model explanation utilizing rules of origin

Advantages of the Philippines

If exports happens to below countries…

ATIGA, RCEP

AKFTA, RCEP, PKFTA

AJEPA, PJEPA, RCEP

ACFTA, RCEP

Signing Various agreements with one country as Philippine or ASEAN

Creates an opportunity to enhance the utility and flexibility of the agreements

Case Model for Comparative Origin Criteria between FTA agreements

The Philippines, being a member of ASEAN, has engaged in various Free Trade Agreement (FTA) negotiations either as part of ASEAN or independently. This diversity can be leveraged for beneficial outcomes.

PSR

Product Specific Rules

PASSThe most critical aspect in determining the origin as PHILIPPINE lies in assessing whether the criteria for origin determination on a PSR (Product Specific Rules) are met.

By comparing and analyzing the origin criteria across agreements concluded with a single trading partner, favorable criteria for origin determination can be chosen, enabling the issuance of a Certificate of Origin as below example.

Example

Export Destinations

Korea

Main Export Products

Processed Food

HS CODE

2106.90

Tariff Rate

MFN Product Specific Rules

8%

AK-FTA ASEAN-Korea Free

Trade Agreement

0%

RCEP Product Specific Rules

6.4%

The Philippines utilizes two agreements with Korea: the Korea-ASEAN and

RCEP.

Comparing the PSRs of each agreement yields the following results.

AKFTA

- Condition 1

- RVC 40% Regional Value Content (RVC) The percentage of a product's value that must come from within the region to qualify for preferential treatment under a trade agreement.

- Condition 2

- WO (HS 1211.20, 1212.21, 1302.14, 1302.19) Wholly Obtained (WO) Refers to goods that are entirely produced or obtained within a single country, often used in determining the origin of agricultural or natural products.

- Condition 3

- Conditions 1 and 2 must be met simultaneously

RCEP

- Condition 1

- RVC 40%

- Condition 2

- CTH Change of Tariff Heading (CTH) A rule that requires a product to undergo a change in tariff classification at the heading (four-digit) level to qualify as originating under a trade agreement.

- Condition 3

- Condition 1 or 2 must be met

BOM (Bill of Materials)

A

-

Raw Material

Raw Material

-

HS Code 1211.20

Origin ZZ

Amount 3.5

B

-

Raw Material

Raw Material

-

HS Code 1211.20

Origin ZZ

Amount 3.5

C

-

Raw Material

Raw Material

-

HS Code 1211.20

Origin ZZ

Amount 3.5

D

-

Raw Material

Raw Material

-

HS Code 1211.20

Origin ZZ

Amount 3.5

Originating Materials 9 Originating Materials B (PH, 6) C (PH, 3) Total : 6 + 3 = 9

EXW 9.5

Non-originating 5.5 Non-originating A (ZZ, 3.5) D (ZZ, 2) Total : 3.5 + 2 = 5.5

FOB 10

Origin Determination

AKFTA

- Condition 1

- BD method : (10,000-5,500)/10,000 = 45% Pass

- Condition 2

- 1211.20 cannot meet WO criteria Non-Pass

- Condition 3

- As a result, example product does not meet origin criteria of AKFTA PSR

RCEP

- Condition 1

- BD method : (10,000-5,500)/10,000 = 45% Pass

- Condition 2

- 1211.20 cannot meet WO criteria Pass

- Condition 3

- Example product meet either origin criteria of RCEP PSR

As a result, AKFTA Certificate of Origin can not be issued but RCEP Certificate of Origin

can be issued.

Buyers can benefit from tariff savings using RCEP certificate of

origin.