Utilization of PEZA

What is PEZA?

REPUBLIC OF THE PHILIPPINES

Philippine Economic Zone Authority (PEZA) promotes the establishment of economic zones in the Philippines for foreign investments. PEZA is also the Philippine government agency tasked to extend assistance, register, grant incentives to and facilitate the business operations of investors in export-oriented manufacturing and service facilities inside selected areas throughout the country proclaimed by the President of the Philippines as PEZA Special Economic Zones.

Benefit of PEZA registered corporations

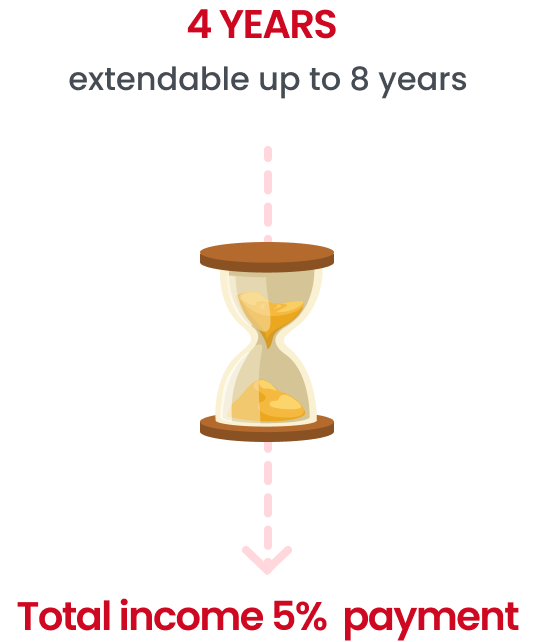

Income Tax Exemption

Corporate income tax exemption for up to 4 years

(extendable up to 8 years), followed by a 5% payment of total income thereafter.

- Manufacturing

- IT

- Tourism Medical, Retirement Industries

- Agriculture

Eligible for income tax exemption.

Other Tax Exemptions/Financial Support

-

Exemption from branch remittance tax when establishing a branch office.

-

Import duty exemption for raw materials.

-

Exemption from business permits, city permits issuance, hygiene inspections, and waste disposal taxes.

-

Exemption from export tax and port usage fees.

-

Import duty exempt additional deductions for employment costsion for raw materials.

-

Exemption from value-added tax on communication, electricity, and water fees.

-

Exemption from local business taxes.

Incentives for Location Support

-

Exemption from branch remittance tax when establishing a branch office.

Other

-

Employment of non-resident foreigners allowed (Supervisory, Technical, Advisory roles).

-

Special investor visa issuance (Including immediate family members).

-

Remittance of profits allowed without prior approval from the Bangko Sentral ng Pilipinas (BSP).

-

Up to 30% of produced goods can be sold within the Philippines.

-

Simplified export-import procedures.

-

Support for obtaining an Environmental Compliance Certificate (ECC).

-

Other provisions mentioned in administrative orders.

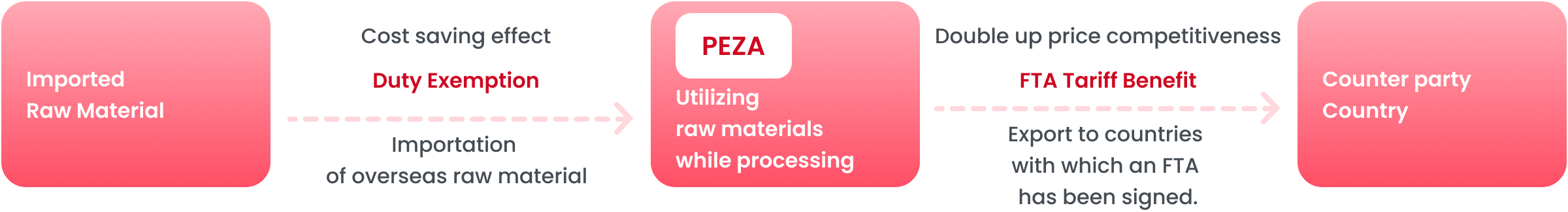

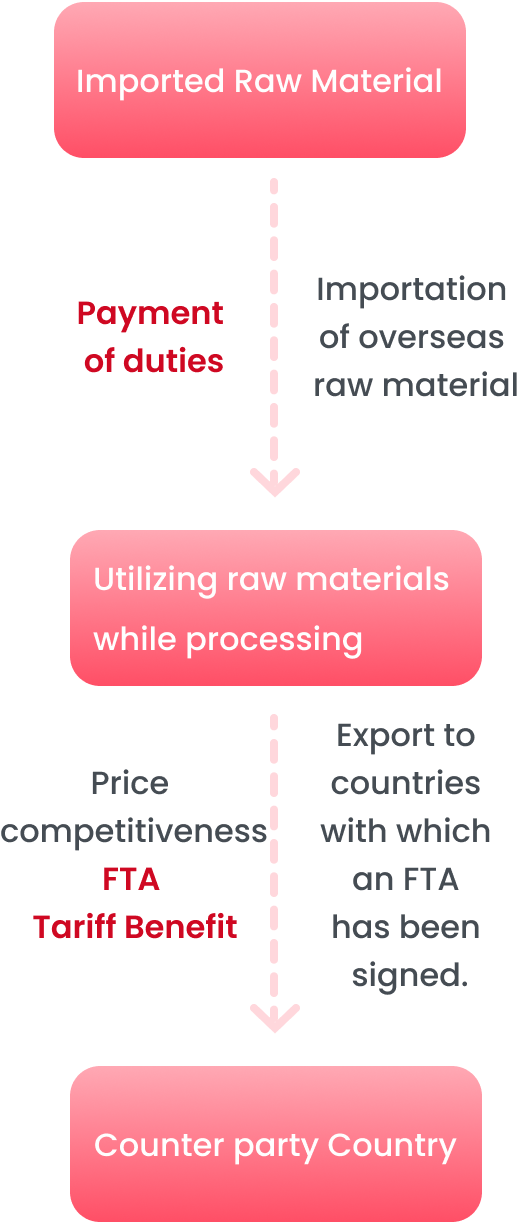

Promotion of Processing and Trade Utilizing PEZA

for Enhanced Trade Activity Model

One of the benefits for companies registered with PEZA is the tax reduction on imported raw materials.

The ability to utilize foreign raw materials in a tax-deferred status enables alleviation of financial burdens on companies and fosters activation of processing and trade.

General Process

PEZA Registered Corp